Financial Aid conducted a mini-conference on Oct. 18 in University Center North.

The attendees were treated to light refreshments as they had the opportunity to attend several 30-minute lectures on education financing — each lecture specifying different ways to get money for college.

Parents searching for ways to help finance their child’s education, attended the event.

Becky Seals, middle school teacher, has a daughter who is a sophomore at IU Southeast and another daughter who will be attending Purdue University next fall.

Seals said she found the lectures to be well worth her time.

“I sat through another [Free Application for Federal Student Aid] meeting at Purdue,” Seals said. “This one was much more informative about the loans and filling out the forms.”

The lectures were broken down in four parts.

Two of them covered applying for money through the FAFSA, as well as the importance of properly filling out forms and what to expect after submitting them.

The other two covered scholarships and borrowing money through loans.

Kimberly Lewis, counselor for Financial Aid, said because FAFSA forms can be difficult to fill out, help is available.

“There is something called College Bowl Sunday, which is nationwide,” Lewis said. “Because FAFSA tends to be that confusing, they feel they need to offer a free service to help you get the money you need for college.”

This College Bowl Sunday event will take place on campus on Feb. 12, 2012, from 2 to 4 p.m.

There are several types of college loans students can apply for to help fund their education.

The better loans are Stafford Loans, which are through the Federal Government, and they have a fixed interest rate of 6.8 percent.

Direct Plus Loans are for students who do not receive enough money in other loans, grants or scholarships and still have outstanding charges that financial aid didn’t cover.

The money can be used for books or housing expenses and has an interest rate of 7.9 percent fixed interest. Due to the high interest rates of Private Loans, they are not the best loans to receive in helping to pay for college.

Rachel Delbridge, counselor for Financial Aid, said it is very important for students to come up with a budget, taking in consideration all expenses before borrowing money.

“You need to be careful because it is yours to pay back when you graduate,” Delbridge said. “Only take out what you need and utilize other resources first before you take out loans.”

Scholarships are another source of aid, which do not have to be paid back.

However, they can be very competitive, are not guaranteed and can be limited in the amount depending on the donor.

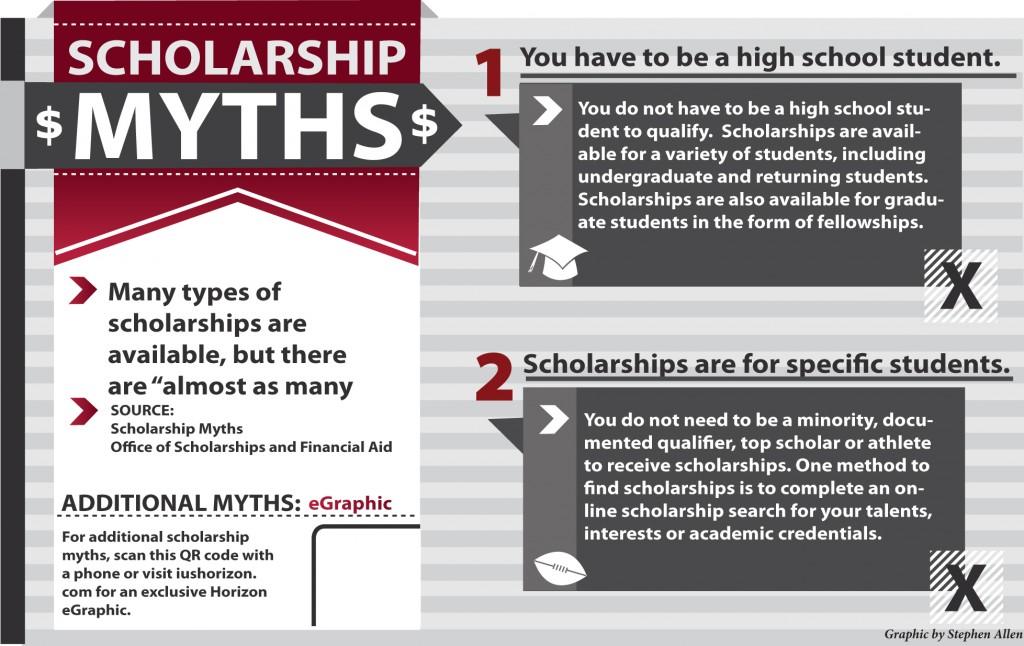

There are different types of scholarships that students can receive or can apply for.

Campus-based scholarships are awarded by the colleges, but there are deadlines that apply to the dates of admission to the school or to the scholarship, so students should be aware of them when applying.

Private donor scholarships are applied for and awarded from outside the universities, from an employer or through local or regional agencies or companies.

Also, scholarships can be found on the Internet by doing a private search. However, there are large quantities, each with their own requirements and stipulations.

Sara Wooden, associate director of Financial Aid, said students should be aware of scams while conducting a search for scholarships on the Internet.

“Many companies appear legitimate, but they really want you to give them your personal or account information,” Wooden said. “Never give out your Social Security number, credit card or bank account numbers unless you know for sure where it is going.”

However, the Internet can also be a good resource to look for information about financial aid programs, loans and scholarships in order to help parents and students understand more about what is available.

For more information on this or other ways to help finance education, students should contact Financial Aid or go to www.studentaid.org.

By STEVE NICHOLS

Staff

stevnich@ius.edu