Students, not customers

An on campus reaction to the potential of debt free education.

March 7, 2016

Free does not always mean better.

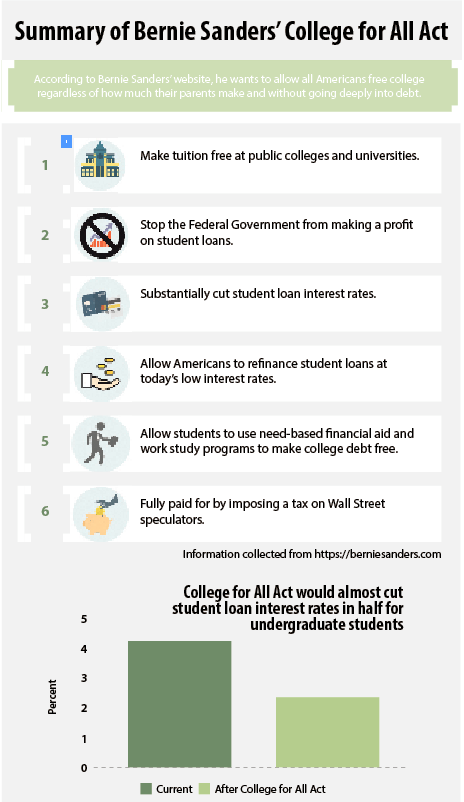

Senator Bernie Sanders’ College for All Act states that all students deserve to go to college tuition and debt free no matter how much money their parents make.

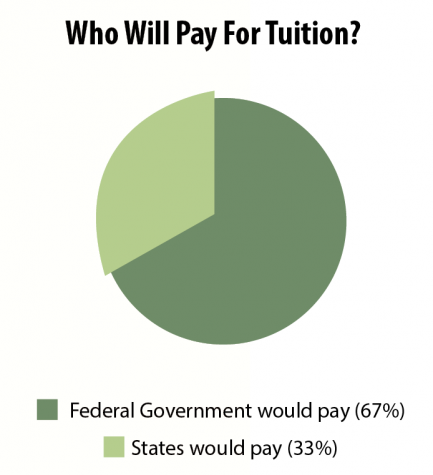

The act, which would only apply to public colleges and universities, would make college tuition free by taxing Wall Street. Along with these taxes, Sanders plans to cut loan interest rates in half and bring them back to their 2006 levels.

IU Southeast financial aid staff and a few students express how they feel about the College for All Act.

Traci Armes, director of Financial Aid, views debt free and tuition free as separate concepts.

“Tuition free is a concept in which federal and state governments would increase their spending on higher education so that the costs were covered,” Armes said. “Debt free means the cost would be manageable enough with various funding sources to where students could afford the educational expense without having to take out loans.”

Armes said she feels students are already encouraged to get through college as debt free as possible.

Scholarships and grants are available and students are advised to utilize them.

Jacob Gibson, philosophy sophomore, supports the idea of college being debt free.

“It’s a laudable goal that we should definitely be working towards,” Gibson said. “The current system of putting young people in deep debt is completely untenable.”

Michael Moeller, IUS graduate, thinks free tuition is possible but may have repercussions we are currently unaware of.

“The decision-makers will need to be well informed on all benefits and potential inconveniences that would come with it,” Moeller said.

According to berniesanders.com, tuition used to be free at many colleges and universities, such as the University of California.

Lauren Greider, associate director of Financial Aid, said it was during the Reagan administration that tuition at colleges stopped being free.

“Higher education went from being treated as a public good to a private one,” Greider said. “This has had lasting implications on funding and appropriations for institutions of higher education.”

According to sanders.senate.gov, “this legislation is offset by imposing a Wall Street speculation fee on investment houses, hedge funds, and other speculators of 0.5 percent on stock trades (50 cents for every $100 worth of stock), a 0.1 percent fee on bonds, and a 0.005 percent fee on derivatives.”

It has been estimated that the plan would raise hundreds of billions of dollars a year.

“There are dozens of ways to tax the ambiguous Wall Street, most of which I would be fine with,” Moeller said. “But it is my understanding that only doing that will not lead to free education.”

Another of Sanders’ goals with the act is to cut loan interest rate in half and bring it down to what it was in 2006.

According to berniesanders.com, loan interest rates are at 4.29 percent. If his plan were in effect, it drop down to 2.37 percent.

Armes numbers contradict Sanders.

“The interest rates in 2006 were higher than they are today. Subsidized & unsubsidized loans had an interest rate of 6.8 percent in 2006, and today it is 4.66 percent,” she said. “If the interest rate is higher, students will be paying more over the life of the loan, thus incentivizing repayment in a timely manner.”

Gibson said he believes loan interest rates are really high.

“The idea that young people should start their adult lives and careers with massive debt is insane,” he said.

Chelsea Dillon, psychology sophomore, also said she thinks loan interest rates are high.

“When checking into loans, I received a quote for an 11.2 percent interest rate and another for a 9 percent interest rate,” she said. “Luckily I was able to receive a Stafford loan with a lower interest rate, but it is still adding up every day.”

According to the College for All Act, Sanders’ wants to allow all students, no matter how much their parents make, to attend college tuition free.

“It’s hard for parents to put multiple children through college at once, and the way financial aid is, you don’t always receive enough money to cover your entire semester/year,” Dillon said. “Some don’t receive any money at all based solely on their parents’ income and that’s unfair too, because there’s always many more factors to consider than just what the FAFSA forms ask.”

People are attracted to the word free, but to Moeller free does not always mean better.

Moeller said he thinks if college was tuition free when he attended he would have been less motivated.

“I would have rather spent time doing independent research on projects and interests,” he said. “I say this only because once everyone gets a degree, the degree is devalued and there was a lot of time wasted learning non-specific lessons.”

Dillon said she thinks it depends on the student.

“Some may not feel they need to take it as seriously if they aren’t spending their own money, but I believe the majority of students will take college just as seriously because, in the end, you still need to put in the work to receive your degree,” she said.

For Gibson, free tuition would be better.

Gibson said that, for the longest time, the lack of money was preventing him from attending IUS.

With the idea that college may become tuition free it could drastically increase enrollment.

Moeller said he thinks if college were free, the dropout rate would increase due to the act making it impossible for anyone to enroll.

Moeller said he thinks that, if college were free, the dropout rate would increase due as the act would widen the pool of potential enrollees.

Dillon views this differently.

“I think it will make it easier for students to not feel as rushed,” Dillon said. “But I think they will be just as motivated to finish.”