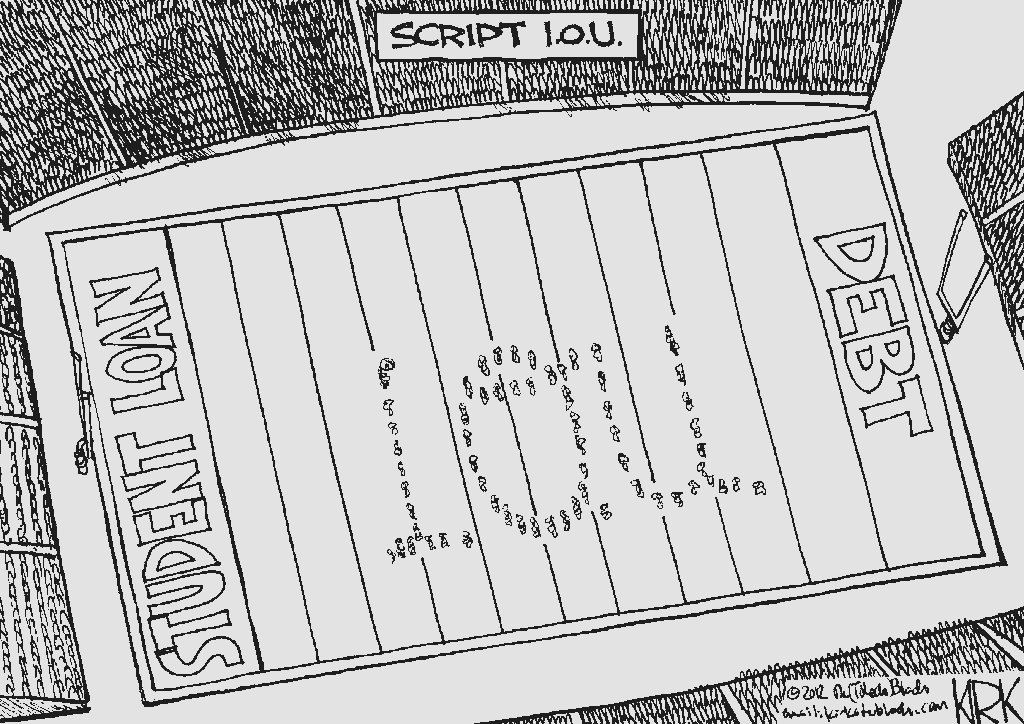

So far in my collegiate career, I have racked up a tab of more than $12,000 made payable to the Department of Education — a tab that is continuously increasing and will probably be owed for the majority of my life.

The current amount of debt I have collected in four years is not as high as most students because I qualify for Pell Grants and supplements from the state.

Luckily enough for me, I have poor parents, which qualifies me for federal assistance.

However, the option to pull out and abuse $5,500 in student loans has been available to me since I started college.

I did start off at an expensive private school for a major totally unrelated to journalism — culinary arts — and that accrued quite a bit of my $12,000 debt.

I did start off at an expensive private school for a major totally unrelated to journalism — culinary arts — and that accrued quite a bit of my $12,000 debt.

My mother has a lot more student debt collected up from her collegiate experience, and I know that it will be passed down to me and my siblings to pay it off. However, we are all pretty broke ourselves.

The option to pull out more loans is still there for me to take advantage of, and I do, justifying it with reasons like “my car broke and I need a new one.”

I am not feeling the penalties of it now, and, even though the educated person inside of me is telling it is stupid, and I should not take out the extra money, the broke college student usually has a bigger voice and says, “Hey, we can buy that shiny new pair of jeans.”

I understand it is my responsibility to pay back my loans when I get out of college. However, when I finish my degree at IU Southeast I will be moving on to graduate school shortly after.

Therefore, I will just throw the loans back into deferment to be looked at later, still increasing that never-ending tab.

The ability to put myself further in debt and for colleges to allow their students the ability to do so even when they do not need the money is careless. Chances are I will not pay a dime of it back until after I have my doctorate degree, or, if they are lucky, I might pay some of it after I get my master’s degree.

The whole concept of student loans should be reconsidered. Offer it to those who need it and do not offer them to people who do not need it to pay their tuition.

If I am anything like my fellow college students — and I am sure that I am — they are using their unneeded money on the same nonessential “goodies” and technological crap.

By the time I am all done with school, my undergraduate and graduate degrees, while I hope I will have a good enough job to pay back my loans in a reasonably quick manner, it is not a guarantee. Seeing the tuition rates of graduate school — $10,000 or more per year you are enrolled — the odds are becoming slimmer and slimmer.

Since the option is still available to me, and I am still in lower-class America, I will continue to take the extra money.

It seems to be the more debt a person is in the more successful they tend to be. A person has a home mortgage, a car loan, student loans and credit cards to prove just how successful that person claims to be.

If that is the case then by the time I have all my degrees I should be hella successful.

Sometimes college students have the philosophy, “YOLO” — you only live once — but what they do not realize is just how much suffering they may be putting themselves into.

Maybe I should be more responsible, maybe I should not and just keep taking what I can get. Either way I owe you, and I probably always will.

By BRYAN JONES

Profiles Editor

jonesbry@umail.iu.edu