Although the deadline for the Free Application for Federal Student Aid [FAFSA] is approaching, there is help available to students to complete the form on time and receive aid that with paying for school. Other forms of financial aid such as grants, or loans are available through filling out the FAFSA form.

Office of Financial Aid: http://www.ius.edu/financialaid/

Hours: Monday- Thursday 8:00 a.m.- 5:00 p.m.

Friday 8:00 a.m.- 5:00 p.m.

Phone Number: (812) 941-2246

FAFSA Application: https://fafsa.ed.gov/

College Goal Sunday: Free help on the FAFSA, open to the community.

Date: Feb. 23, 2014

Time: 2:00 – 4:00 p.m.

Place: IUS Library

Did you know?

•March 1, 2014 is the deadline for the scholarship application through IU Southeast.

•Aid is available for online, summer and overseas study. Contact the Office of Financial Aid for more information.

•Special Circumstances Appeal Forms are available that can help increase financial aid if income changed dramatically, medical expenses were high, natural disaster cost large sums, marital status changed, if the number of members in the household increased or number of people in college increased.

•Other types of financial aid are also available through the FAFSA. Click the link to read about the different type or if you have other questions about the FAFSA: http://fafsa.gov/help.htm

March 10 is the Indiana deadline for to submit FAFSA form. This deadline qualifies students for state aid such as 21st century scholars, Frank O’Brien grants and veteran benefits for children.

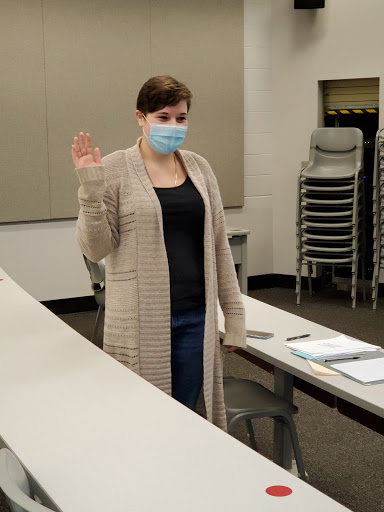

Leslie Turner, financial aid counselor, said that there seems to be a misconception among students who wait until after their tax returns are completed before filing their FAFSA. This can potentially cause them to miss the March 10 deadline, losing out on a lot of money, Turner said.

“Use estimates,” Turner said. “You are allowed to continue and go back after taxes are done. A newer feature also allows tax information to be imported from the IRS[ Internal Revenue Service].”

The IRS data retrieval tool is available to autofill the tax portion of the FAFSA and can be used one- to-two weeks after tax returns have been filed if filed electronically. It takes six-to-eight weeks for paper tax returns to be available with the IRS data retrieval tool.

Information needed on the FAFSA:

• social security number

• adjusted gross income

• income tax amount

• tax exemptions

• total current balance of cash, savings and checking accounts

• net worth of investments, untaxed income, and child support paid or received

The application is available online at https://fafsa.ed.gov/.

Sierra Ash, biology junior, said she thinks the FAFSA is a good tool for students to use.

“Any aid you can get is awesome because college is expensive,” Ash said.

Ash also said she uses estimates to complete her enrollment and fixes the amounts as soon as the tax information is received.

“If you filled it out from previous years it’s not too bad,” Ash said. “I use tax information from last year to estimate and go back to correct later. It’s better to get it done early.”

Although March 10 is the Indiana deadline, FAFSA applications turned in past the March 10 deadline are still valid and can help a student attain aid for the current or upcoming semester, Turner said.

“Many times students think they lost their chance when they miss the deadline so they don’t bother to apply,” Turner said. “But it’s not too late. I just helped a student apply for the FAFSA for this semester.”

Sunday, Feb. 23 from 2 – 4 p.m. is College Goal Sunday, a day to help students with their FAFSA’s, Turner said. Computers will be available as well as financial counselors to assist students and other members of the community with completion of their FAFSA. It will be located in the IUS library and is open to the community.

“You don’t have to stay the whole time,” Turner said. “There will be computers set up and we will help students fill out their forms, then they may leave.”

Turner said the most important thing to remember is that it is okay to stop and ask for help. There is a save and exit option while filling out the FAFSA electronically.

Financial aid counselors are available to help students, Turner said. They can answer questions by phone or by appointment.

The Office of Financial Aid is open Monday through Thursday 8 a.m. to 6 p.m. and Friday from 8 a.m. to 5 p.m. Call (812) 941-2246 to speak with a counselor.

Katie Kincaid, business junior, said the application is easy until the tax information is required.

“The taxes throw you for a loop,” Kincaid said. “I’ve gotten my mom to help me when I don’t understand.”

Although the tax information can be confusing the financial aid counselors are willing to help whether that means a meeting with a student or with a student and their parent present, Turner said.

“Filling out the FAFSA can make all the difference,” Turner said. “It’s very important. We are lucky to have it in the U.S.”