On average, it takes 25 seconds to count to 100, but multiply that out and it would take 50 years to count to 1 billion.

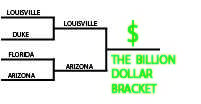

$1 Billion is the prize offered by Warren Buffet for a perfect NCAA bracket. The odds are one in 128 billion that someone will win, but the possibility is still out there. What could someone conceivably do with that much money and could it turn out to be more hassle than it’s worth?

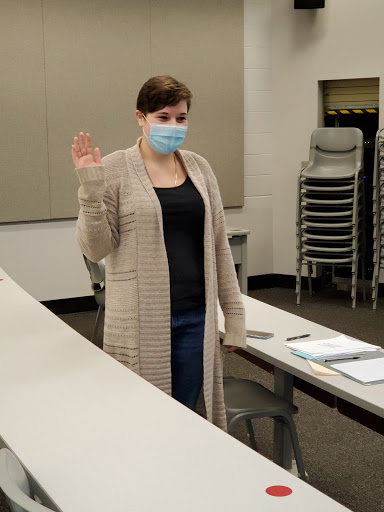

“I don’t think any one person should have $1 billion. I think that makes a person a little too influential,” Emily Rodeheffer former IUS Psychology major said, “for me to have $1 billion without having worked for it or without having earned it would almost certainly make me irresponsible with it.”

Rodeheffer said she has a family member who was promised a large sum of money through a business deal that never went through. The promise of money led to terrible spending decisions that left the family member bankrupt.

“They would almost certainly expect me to give them a big chunk of money when they’ve made so many irresponsible decisions before,” Rodeheffer saId, “they’re just now getting back on their feet. I don’t know if I could in good conscience give it to them, and yet it would cause a rift.”

Rodeheffer said sudden owners of large sums of money have enticements that they never could have considered before.

“It’s like when I get my tax check, it feels like found money,” Rodeheffer said “Instead of spreading it out, I feel like I can just spend it, then I have to get back to reality. I can’t imagine how long it would take to spend $1 billion. I might never come back to reality.”

Information from totalbankruptcy.com says that one-third of lottery winners go bankrupt within five years. Professional athletes who sign multi-million dollar contracts also have a surprising rate of bankruptcy.

Veronica Medina, assistant professor of sociology, said many athletes have not been taught how to manage their money. She said she knows of a basketball player, who recently signed a large contract, that would throw his clothes away when they got dirty and buy new ones.

“My issue with Warren Buffet’s schtick is that it’s an individualistic approach to what could potentially be a problem, “ Medina said, “given what Buffet stands for, in term of his critiques of the tax structure, and his idea that people have to work hard for what they get…I’m actually kind of surprised that that the $1 billion wouldn’t go to charity.”

Buffet along with fellow financial titan, Dan Gilbert, will stand to earn a profit by promoting Quicken Loans, a company from Detroit, by drawing millions of people to the website in order to fill out their brackets.

Medina won’t be entering Buffet’s bracket contest, preferring to enter a low stakes pool with friends. She thinks that an individual being able to win that much money ,off of what largely ends up being a guess, is a distraction from larger policy solutions that could benefit more people.

“I don’t think we should ever rely on the expectation that we might come into a lot of money,” Medina said, “because that’s not the reality.”

The largest lottery jackpot ever won in the US was $370.8 million, which still pales in comparison to a $1 billion prize.

The tournament play in games were held last night. The field of 64 tournament begins tomorrow, March 20, and culminates with the championship April 7 in Dallas.