As the fall semester begins to wrap up, I find myself worrying about something approaching soon.

As the fall semester begins to wrap up, I find myself worrying about something approaching soon.

I am not nervous about the large load of homework I have to conquer, finishing everything for my classes or finals approaching in December.

I am not even concerned with what classes I will be taking next semester or making sure my credits are all lined up to graduate.

What worries me the most is something far beyond my control — financial aid.

Since I began my college experience at IU Southeast, every year has been the same.

As soon as February rolls around, I begin thinking about having to fill out my Free Application for Federal Student Aid.

As the weeks go on, FAFSA acts like my subconscious, trying to warn me of an impending doom as I continue to procrastinate.

Eventually, I end up scrambling around like almost everyone else, finding the correct paperwork and filling in the accurate information as needed.

However, every time I hit the dependency status of the FAFSA form, it always bothers me the most.

Not only do I have to wait desperately while my parents’ procrastinate on handing me their tax forms, but I spend more time figuring out information that should not even be considered when determining the amount of financial aid I receive.

FAFSA is an unfair system, but only toward certain people.

My main problem with the FAFSA system is they only consider those older than 24 to be independent of their parents.

FAFSA assumes all students under the dependent age cap are supported by their parents, resulting in unfair amounts of financial aid.

I made the choice to live at home while attending college.

However, even if I had moved out to live on my own, I would still need to claim myself as a dependent.

There is something wrong with this picture.

It seems if students are from a middle class family, with two parents working decent jobs, everyone is categorized as the same.

I do not know about everyone else, but just because I live with my parents and I am under the age of 24 does not mean they are able to provide me with the necessary funding to attend college.

For the most part, students who attend college in the hopes of obtaining a bachelor’s degree remain in school for four to five years.

The fact that 24 is the age cap for dependent students seems very senseless, especially since I expect to graduate by the time I am 23.

Not to worry, though.

As long as I am working on my master’s, married, have a child or am homeless, I can get around the system.

Even when I factor in the Expected Family Contribution on the FAFSA form, I still somehow end up with just loans — all of which I have to pay back.

In essence, the system that began back in the 1950s is outdated.

While President Barack Obama is trying to relieve the huge amount of accumulated student debt, like everything else, I doubt it will have much of an impact on present students.

Throughout my college education, I strive to always do well in my classes, but it never seems to pay off.

I know it might have an impact on employers, but in reality, most businesses just look to see if students have a degree in anything before hiring them.

Even with my grades, I am not eligible for grants or scholarships. Only once have I been able to receive a grant.

I did have a scholarship from IU Southeast when I started college, until it was taken away from me due to lack of funding.

The fact of the matter is students who work hard get little in return.

I am not saying it is the fault of the students, but it is the error of the system in place.

FAFSA has been turned into a complete scam, where students whose parents refuse or are unable to pay for their college education are being completely misrepresented.

With college tuition rising, it would be impossible for me — and many other students alike — to afford a degree with low-paying jobs.

However, on the other hand, the situation cannot be completely avoided forever.

Something needs to be done to not only update the system but reduce the amount of loans some students receive compared to others with grants and scholarships alone.

The U.S. Department of Education needs to lower this outdated system in order to achieve fairness for everyone.

In the meantime, I will still be dreading the day when my FAFSA submission is due.

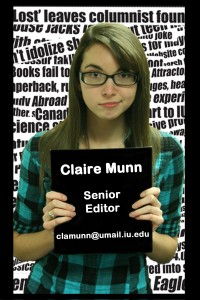

By CLAIRE MUNN

Senior Editor

clamunn@umail.iu.edu

By CLAIRE MUNN

Senior Editor

clamunn@umail.iu.edu

As the fall semester begins to wrap up, I find myself worrying about something approaching soon.

I am not nervous about the large load of homework I have to conquer, finishing everything for my classes or finals approaching in December.

I am not even concerned with what classes I will be taking next semester or making sure my credits are all lined up to graduate.

What worries me the most is something far beyond my control — financial aid.

Since I began my college experience at IU Southeast, every year has been the same.

As soon as February rolls around, I begin thinking about having to fill out my Free Application for Federal Student Aid.

As the weeks go on, FAFSA acts like my subconscious, trying to warn me of an impending doom as I continue to procrastinate.

Eventually, I end up scrambling around like almost everyone else, finding the correct paperwork and filling in the accurate information as needed.

However, every time I hit the dependency status of the FAFSA form, it always bothers me the most.

Not only do I have to wait desperately while my parents’ procrastinate on handing me their tax forms, but I spend more time figuring out information that should not even be considered when determining the amount of financial aid I receive.

FAFSA is an unfair system, but only toward certain people.

My main problem with the FAFSA system is they only consider those older than 24 to be independent of their parents.

FAFSA assumes all students under the dependent age cap are supported by their parents, resulting in unfair amounts of financial aid.

I made the choice to live at home while attending college.

However, even if I had moved out to live on my own, I would still need to claim myself as a dependent.

There is something wrong with this picture.

It seems if students are from a middle class family, with two parents working decent jobs, everyone is categorized as the same.

I do not know about everyone else, but just because I live with my parents and I am under the age of 24 does not mean they are able to provide me with the necessary funding to attend college.

For the most part, students who attend college in the hopes of obtaining a bachelor’s degree remain in school for four to five years.

The fact that 24 is the age cap for dependent students seems very senseless, especially since I expect to graduate by the time I am 23.

Not to worry, though.

As long as I am working on my master’s, married, have a child or am homeless, I can get around the system.

Even when I factor in the Expected Family Contribution on the FAFSA form, I still somehow end up with just loans — all of which I have to pay back.

In essence, the system that began back in the 1950s is outdated.

While President Barack Obama is trying to relieve the huge amount of accumulated student debt, like everything else, I doubt it will have much of an impact on present students.

Throughout my college education, I strive to always do well in my classes, but it never seems to pay off.

I know it might have an impact on employers, but in reality, most businesses just look to see if students have a degree in anything before hiring them.

Even with my grades, I am not eligible for grants or scholarships. Only once have I been able to receive a grant. I did have a scholarship from IU Southeast when I started college, until it was taken away from me due to lack of funding.

The fact of the matter is students who work hard get little in return.

I am not saying it is

the fault of the students, but it is the error of the system in place.

FAFSA has been turned into a complete scam, where students whose parents refuse or are unable to pay for their college education are being completely misrepresented.

With college tuition rising, it would be impossible for me — and many other students alike — to afford a degree with low-paying jobs.

However, on the other hand, the situation cannot be completely avoided forever.

Something needs to be done to not only update the system but reduce the amount of loans some students receive compared to others with grants and scholarships alone.

The U.S. Department of Education needs to lower this outdated system in order to achieve fairness for everyone.

In the meantime, I will still be dreading the day when my FAFSA submission is due.