On the Issues: Student Loan Debt

On Tuesday Nov. 8, voters will no longer be able to practice the luxury of being undecided in the throes of voting season, as this Tuesday in particular is Election Day. Across the country, voting booths will be filled with predominantly mild-mannered participants, each one contributing in the century-old tradition of democracy being practiced in the Western world.

As per four-year tradition, Americans will be handed the opportunity to cast their vote as to who will be leading the nation for the next several years, a right citizens express frequent privilege to partake in.

While many of the issues being considered in the upcoming election on Nov. 8 are of great significance, not all may seem so close to home for students on the verge of graduating or those who have just enrolled in college.

National economics and foreign relations are examples of important issues that might be considered when entering a polling booth, but students may feel disconnected from said discussion points as they are not immediately relative to their situation.

One topic that is at the forefront of many young voters’ considerations is the increasing problem of national student loan debt the U.S. is facing.

According to Forbes, the total amount of national student loan debt has crossed the $1.2 trillion threshold, and no matter one’s partisan affiliation, there is no denying that this number is a growing problem.

The two central presidential candidates, Hillary Clinton and Donald Trump, each have acknowledged the severity of this increasing issue, and both candidates have expressed their individual plans for putting higher education within reach for all while tackling the realities of the crushing amount of student debt the nation has accumulated.

Hillary Clinton

Under Hillary Clinton’s campaign guidelines, she summarizes what students could expect when attending college in the midst of her presidency: costs won’t be a barrier.

What does this reference exactly? Well, according to her official website, this promise covers a variety of things.

As mentioned on her campaign’s official webpage, Clinton wants higher education to be an option for every person, and not just those who can afford it. She has vowed to make college tuition-free for those potential students whose families bring in less than $125,000 a year.

In the guidance of a Clinton presidency, students who fell in this category would be promised loans by the federal government that would ensure not only a chance at a higher education, but a chance that would leave them debt free, therefore having what would previously be considered a loan functioning as a student grant.

According to Business Insider, this change would begin with families whose annual income is less than $85,000, gradually expanding to higher earning rates as her presidency wore on. With the vast majority of families earning under $55,000 a year, Clinton’s promise would cover 80 percent of households once it hits its benchmark of $125,000 later in her presidency.

In addition to the rule above, Clinton has also showed keen interest in making community college free for all students, a response that followed President Obama’s proposal that the federal government would cover 75 percent of said costs, leaving the remaining 25 percent to state governments.

Now that we know her stance on students expressing interest in higher education, we are left with wondering what she has planned for students already riddled with crippling debt.

For students who are either on the verge of graduating or those that have already familiarized themselves with the inevitable struggles of student loans and the process of paying them back, they may have come to understand that under current rule, the U.S. government doesn’t allow student borrowers to refinance the federal loans they have collected.

However, Clinton wants this to change and if elected, according to the proposals she has presented, she has vowed to refinance existing interest rates on student loans, eventually making them significantly lower than the federal rates that are currently in place for most paying back any debt they had gathered throughout their pursuit of higher education.

As mentioned on her campaign website, the program Clinton wants to put into effect if elected is estimated to help roughly 25 million people, assisting both federal and private loan borrowers. The main focal points being a direct cut to the interest rates tacked onto nearly every student loan in circulation.

With all of the changes she wants to put into place if elected, there are still some things that Clinton has yet to mention when discussing student loans. One thing being the subject of said loans and bankruptcy.

In an article published by Forbes, the point is made that alongside mortgages, student loans are one of the few varieties of debt that do not go away following bankruptcy procedures, and Clinton has yet to address this issue, which is likely an indicator that this will not change under her presidential instruction.

Donald Trump

On the opposing end of the political spectrum, there is Republican candidate Donald Trump, whose policies regarding things like student debt and what the future landscape of college, both from a community and university standpoint, may look like vary greatly from those of Clinton.

Trump hasn’t said a tremendous amount about his plan to begin fixing the national debt that the U.S. faces when it comes to student loans, particularly in the debates that he has participated in. With that being said, he and his team have approached the potential reformation of the higher education system off camera.

In an interview with Inside Higher Ed, Sam Clovis, the policy director of Trump’s campaign highlighted some of the issues associated with the higher education system that Trump would be addressing come election season and indicating what his candidate’s solution for each one was.

In contrast to Clinton, Trump wants to remove government’s role in the lending process and leave that entirely up to private lenders and the banks, something that was much more of a common practice until Bill Clinton’s presidency and every year since.

Clovis described Trump’s proposal as favoring the process of student loans to function more so from a capitalistic standpoint than anything else, a viewpoint that he and those behind his campaign have expressed many times.

“We think it should be a marketplace and market driven,” Clovis said.

Instead of money granted and loaned to students existing on a federal level, Trump would rather have it be up to the individual states, with local banks lending local students money so they can attend local colleges.

One thing we do know for certain about Trump’s candidacy and his stance on college debt is he does believe the government should not profit from student loans.

On multiple occasions, and even in his 2015 book “Crippled America,” Trump has said the government should be in the business of making money, but never off of the profits from student loans.

In a 2015 interview with The Hill, a politically oriented newspaper, Trump criticized the federal government for making a profit off of student loans and has gone on to suggest there must be a better way. He has yet to mention anything outside of privatizing all student loans.

“That’s probably one of the only things the government shouldn’t make money off — I think it’s terrible that one of the only profit centers we have is student loans,” Trump said.

The relationship between Trump and the subject of higher education is one that critics have been very skeptical of, as the Republican presidential candidate has said very little on the subject, but what he has said thus far has certainly had an impact.

While Clinton wants to do her best to ensure that college can be debt-free for most, Trump is concerned with a more traditional approach to higher education and the costs that accompany such a schooling.

In the same interview with Inside Higher Ed, Clovis, reacted to the matter when it was brought up by indicating Trump would fight directly against Clinton’s proposal for debt-free college.

“How do you pay for that? It’s absurd on the surface,” Clovis said.

Clovis continued to answer on Trump’s behalf and referenced his candidate’s method of approaching higher education at a community college level, stating that community college was already inexpensive as is and wasn’t in need for a reduction in cost, or an entire disregard to tuition costs, something that Clinton supported.

The final talking point that was discussed in said interview indicated under a Trump presidency, changes would be supported that would allow banks and colleges to consider the future earning potential of students when determining what loans to provide.

In short, this means students pursuing degrees with a lower chance of finding employment immediately upon graduation would stand less of a chance of receiving federal aid than those studying for degrees with a higher employment rate.

As described by Clovis, under a Trump presidency, student loans would essentially be tailored by the provider based on a student’s potential job prospects and the likelihood of them finding employment post-graduation.

“If you are going to study 16th-century French art, more power to you,” Clovis said. “I support the arts. But you are not going to get a job. If you choose to major in the liberal arts, there are issues associated with that.”

The liberal arts and humanities communities have voiced concerns that proposals like the aforementioned would ultimately hurt students pursuing degrees in said fields. This is primarily because such fields are oftentimes dismissed as impractical without any employment rates for them ever actually being observed.

A Trump presidency could very likely result in students being denied of student loans because of their interests in English and Philosophy related degrees. Critics of the policy are already suggesting the action of such a proposal could lead to only the wealthy pursuing degrees related to the arts, leaving other students with only the option of chasing after what the opposing side regards as ‘practical’ means of higher education.

The differences between these two presidential candidates are distinct, especially when considering what they are offering to the public in reference to total student debt and any potential money that students may or may not owe upon college graduation.

Hillary Clinton seems to have a thorough means of attack when it comes to tackling the student debt crisis and preventing any instances similar to it happening again in the near future. However, at $115 billion, the relief program that she has in place is certainly costly and seems to neglect the issues surrounding for-profit colleges, so Trump supporters with their finger on the proverbial pulse have already found error in that.

While behind in comparison to Clinton’s plan, Donald Trump’s proposals for student debt reform seem to revolve primarily around uncertainty as of now. It is evident that he as a presidential candidate would like to see colleges held more accountable for the distribution of student loans.

Unlike Clinton, Trump seems to offer little in the way of resolving the current student debt crisis that the U.S. is in, but as he keeps exclaiming, he may very well have “big ideas, great ideas, just the best ideas,” and in the days leading up to Nov. 8, voters will decide if this is true.

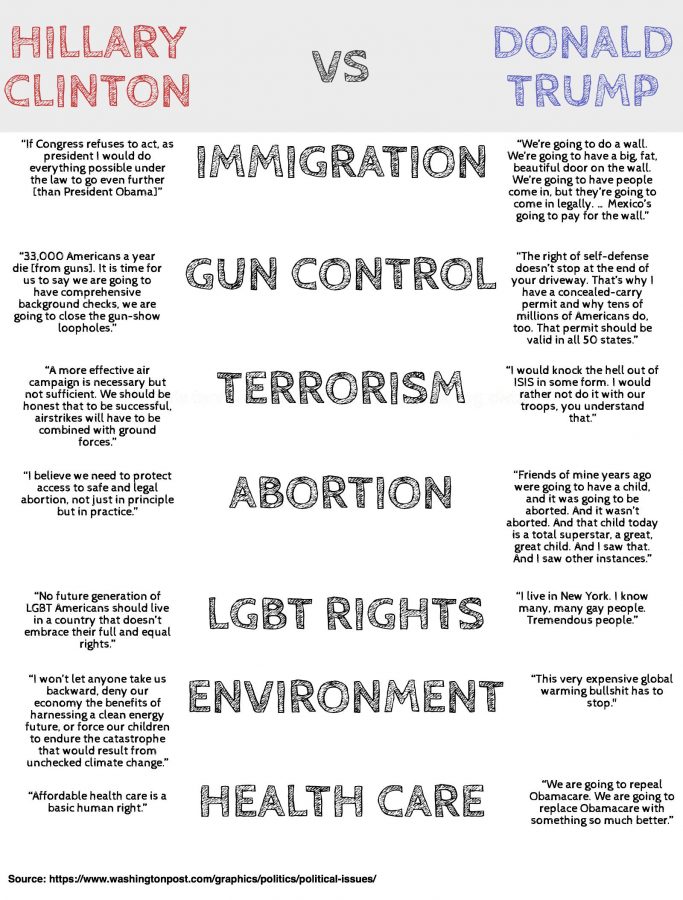

Want to read more? Take a look at the chart below, which details where each of the candidates stand on other major issues, as explained in their own words.