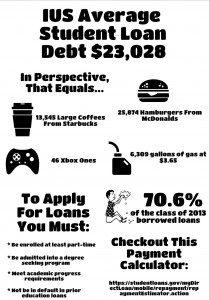

“Students can defer their loans after they graduate until they’re ready to pay them. It’s also easy to get your loans discharged completely or forgiven.” These are statements most students believe to be true. But Rachel Delbridge, financial aid counselor, says otherwise.

Delbridge said the biggest myth about student loans is that students and parents alike believe them to be bad.

“While debt can be burdensome, if a student is borrowing loans and using them for the appropriate costs, then they can be a good investment,” Delbridge said.

According to Delbridge, appropriate costs would be paying just for tuition or covering books. However, if loans are used to improve one’s lifestyle, then that’s not a good use of student loans.

“I know it’s not fun to be with the parents, but right now is the best time for students to save money,” Delbridge said. “There really aren’t that many expenses that are absolutely necessary when you live with your parents.”

Delbridge also said another myth is that students believe it is easy to default on loans.

“What I tell students is unless they’re not paying attention or just don’t care, it’s pretty difficult to default on a student loan,” Delbridge said. “There’s all kinds of things they can do to work with you on getting your loans repaid.”

Delbridge said those things include loan forgiveness plans for certain professions, options such as reducing your payment or postponing it for a temporary period of time, and loan discharge programs.

“For instance, if you end up in a serious car accident and you’re not able to work anymore, you may be able to get your loans discharged,” Delbridge said.

However, Delbridge said it is not an easy process. To be considered for discharge or loan forgiveness, a student has to meet certain criteria.

“Basically the only time you would get discharged is if you die, end up permanently disabled and you meet additional requirements over a three year waiting period,” Delbridge said. “You have to continue to meet that criteria over the three years and your condition must be corroborated by your doctors in order to be discharged.”

Students who do get their loans discharged are no longer able to borrow again.

Delbridge said students are required to pay back loans six months after they graduate, drop below part-time status, or if they leave school entirely.

“Let’s say you came in the fall, left in the spring, but then came back for summer one classes. Your loans will not come due because you have not used your grace period of six months,” Delbridge said.

Delbridge said students also believe they can easily defer their loan payments, but this is not the case. There are only certain reasons students can be eligible to defer their payments.

“If you return to school part time, are in an approved graduate fellowship program or rehabilitation program for the disabled, have had economic hardship, are unable to find full-time employment for a period of up to three years, or if you’re in the military and are called to active duty you may be able to defer your loan payments,” Delbridge said.

If students do not meet that criteria but have become ill – for instance, they are stuck in the hospital for a long period of time – they can file for forbearance. However, students are responsible for all the interest that accrues and Delbridge said forbearance generally lasts no longer than a year.

There are safeguards in place for current and graduating students to assist them in cutting down their debt and repaying their loans.

These safeguards include three different income-driven plans for paying back loans, scholarships and the Bursar’s personal deferment plan.

“There’s the pay as you earn plan, which is based off your income, family size and student loan debt,” Delbridge said. “It takes your income and subtracts it from 10 percent of the poverty level for your family size and divides that amount by 12 months. Ten percent of your discretionary income is your payment for the year.”

The income-based repayment plan is similar but takes 15 percent of one’s discretionary income, while the contingency plan takes 20 percent. Additional paperwork is required for those three programs.

Delbridge said students can also pick the day of the month they want their payment to be due, which can coincide or be opposite of other bills.

“Students have a really bad habit of accepting everything that’s been offered to them,” Delbridge said. “We’re required by law to offer everything they can get.”

Delbridge said another thing most students do not know about is the Bursar’s personal deferment plan, in which students or family members can pay off the tuition in four installments over the semester. However, there is a $45 fee to pay in installments.

“If students want help, we’re here to help plan financial aid need,” Delbridge said.