Horizon Guide: Financial Aid

Creative Commons image courtesy of Pictures of Money on Flickr. https://creativecommons.org/licenses/by/2.0/

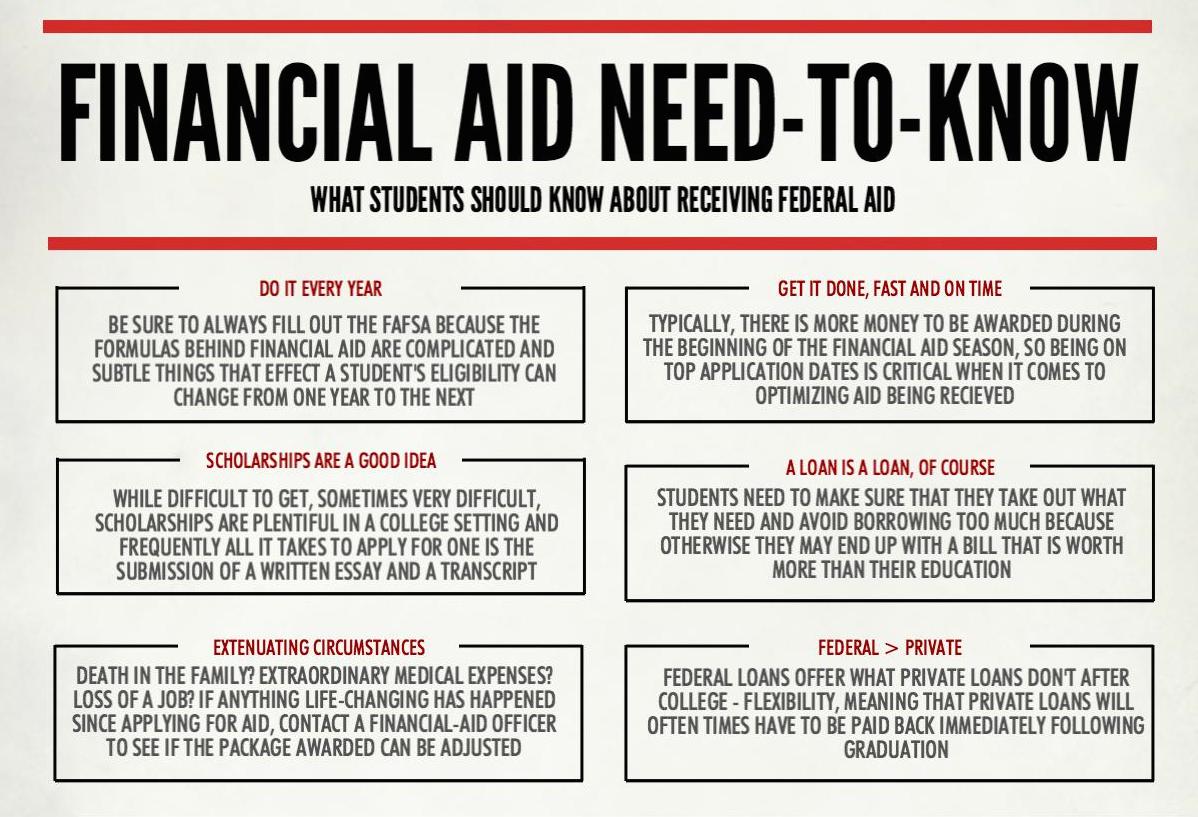

For most students, the application process of financial aid is a laborsome effort, but an effort that is necessary nonetheless. Whether it be the persistent tax forms or knowing which assets and annuities are best to file, making sure that a FAFSA application is free of any inconsistencies is an overwhelming undertaking. However, it doesn’t always have to be.

According to Director of Financial Aid Traci Armes, the first thing students should do when it comes to the process of receiving federal aid is making sure to apply. As simple as the advice is, it is particularly relevant because a surprising amount of students decide not to follow through with the application process. In a 2009 report, analyst Mark Kantrowitz studied why students don’t ultimately apply for federal aid and his findings show that 40.9 percent of undergraduate students do not submit their FAFSA application.

Having worked with plenty of students looking to receive federal aid, Traci Armes states that there are benefits of applying and wants students to always be sure to do so. But she also said that students are likely to have some misconceptions when it comes it going through with the application process for the first time.

“Students assume that only grants are considered ‘financial aid’,” Armes said. “However, any assistance received is considered ‘financial aid,’ including student loans.”

Armes said that students need to understand that federal aid is something they are granted and not something that they are guaranteed. This is why it is so important that students make sure they are able to succeed in their classes.

“All aid is a privilege and not a right. If a student is not making progress towards their degree, aid can be revoked – including student loans,” said Armes.

“Make sure that you complete the FAFSA at fafsa.gov,” said Armes. “If you are an Indiana resident, it is important that you complete the FAFSA prior to March 10 each year for potential state grant eligibility.”

With hundreds of students cycling through the financial aid office each semester, Armes has seen a wide variety of circumstances and things that students neglect when looking to complete their FAFSA.

“Students don’t sit down and come up with a realistic budget while they are going to be a student,” Armes said.

With national student loan debt being at $1.2 trillion, it appears that when students are provided with federal aid they have a tendency of accepting it without considering that the money that they are receiving is not a gift, but is instead a loan that will need to be paid back shortly after graduation.

Students should also know the difference between the loans that are subsidized and those that are not. With subsidized loans, the federal government covers the interest that begins accumulating when the aid is received. However, with unsubsidized loans, students are left to cover the interest themselves upon disbursement of the aid.

“Many students accept their full amount of loans without taking other alternatives into consideration, such as applying for scholarships, or working no more than 20 hours per week to assist with the cost,” Armes said. “We also try to teach students to only take out loans to cover their ’needs’ and not their ‘wants.’”

However, students shouldn’t only have conversations involving which loans are and aren’t subsidized. They should also keep an eye out for the differences between federal and private loans. Similar to subsidized and unsubsidized loans, federal and private loans each have interest rates associated with them that are opposite to one another.

“Students should seek out the gift aid and scholarships first,” said Armes. “Generally speaking, between loans, the interest rates.”

While there may be concerns regarding whether or not they will actually end up receiving awards, Armes said it is best for students to go ahead and fill out the FAFSA because that’s the only way to be certain.

“We can only process aid with a new FAFSA each year,” Armes said. “If a student is not grant eligible, or does not want to take out student loans, they should still complete the FAFSA.”

Scholarships are also integral parts of receiving aid that students should consider each year. Similar to grants, they are essentially free supplements of money and, to be able to qualify for some scholarships, students need to have completed their FAFSA.

“Some scholarships may look at a student’s ‘need’ based on the completed FAFSA. If there is not one on file, they may be overlooked for that particular scholarship,” Armes said.

Armes stated that one of the best ways to be sure of completing a FAFSA application is to get it done as fast as possible. With state deadlines impacting the aid students can receive, The need to get an application done in a timely manner is essential.

“Indiana’s state deadline is March 10 each year. If a student does not complete their FAFSA by that date each year, they will not be considered for the 21st Century Scholar eligibility, or potentially, [the] Frank O’Bannon state grant eligibility,” said Armes.

Similarly, students should apply as early and often as they can for scholarships as well. There are often many to choose from and students should familiarize themselves with the local and national scholarships being offered.

“[Students] should check their community foundations, and national search engines,” Armes said. “And never pay to apply for a scholarship! If in doubt, contact the financial aid office for determining the validity of a scholarship.”

With all of weariness around student loans, Armes said every student applying for federal aid to understand that student loans are in no way the wrong direction to go in when paying for a college education. They can be a very resourceful tool for many.

“Student loans are not inherently ‘evil’ if they are used to assist a student in obtaining their degree,” said Armes.

Issues arise when students are no longer using their received financial aid strictly to assist them in furthering their education. This doesn’t mean that federal aid shouldn’t be used to help pay for necessary expenses, but rather that it should never be used as a means of allowing students to live beyond their already existing means.

“Students run into trouble when they are supporting a lifestyle with the intention of paying it back later,” Armes said.

Students applying for financial aid always need to know what kind of benefits they are able to receive, but also that these benefits may have some interest tacked onto them.

Getting the FAFSA completed accurately and in a timely manner is essential to any aid being received, be it scholarships, grants, or loans.

For any financial aid related questions, students are encouraged to contact the Financial Aid Office at 812-941-2246.

Hello, my name is Jordan Williams. I am a soon to be English graduate and present journalism student. I work as Features Editor for the Horizon, which...